maryland local earned income tax credit

2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. 33 rows States and Local Governments with Earned Income Tax Credit More In Credits Deductions.

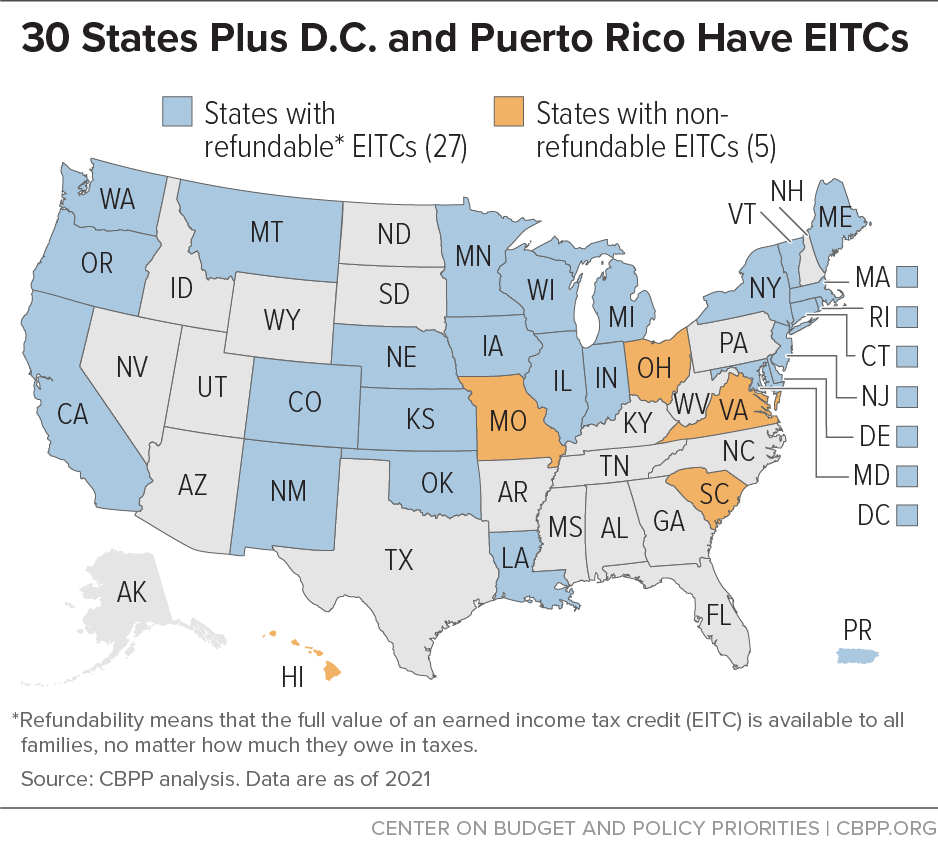

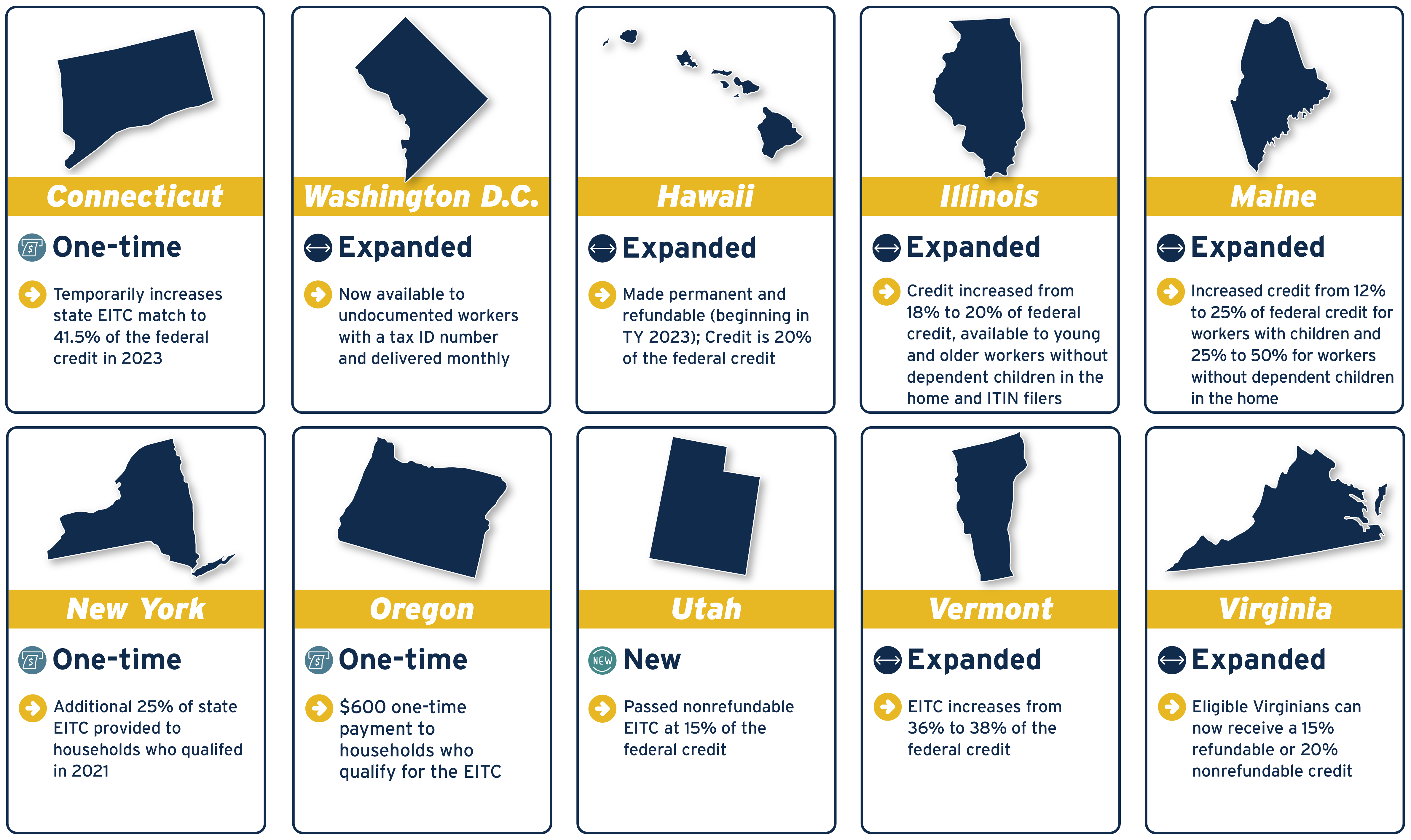

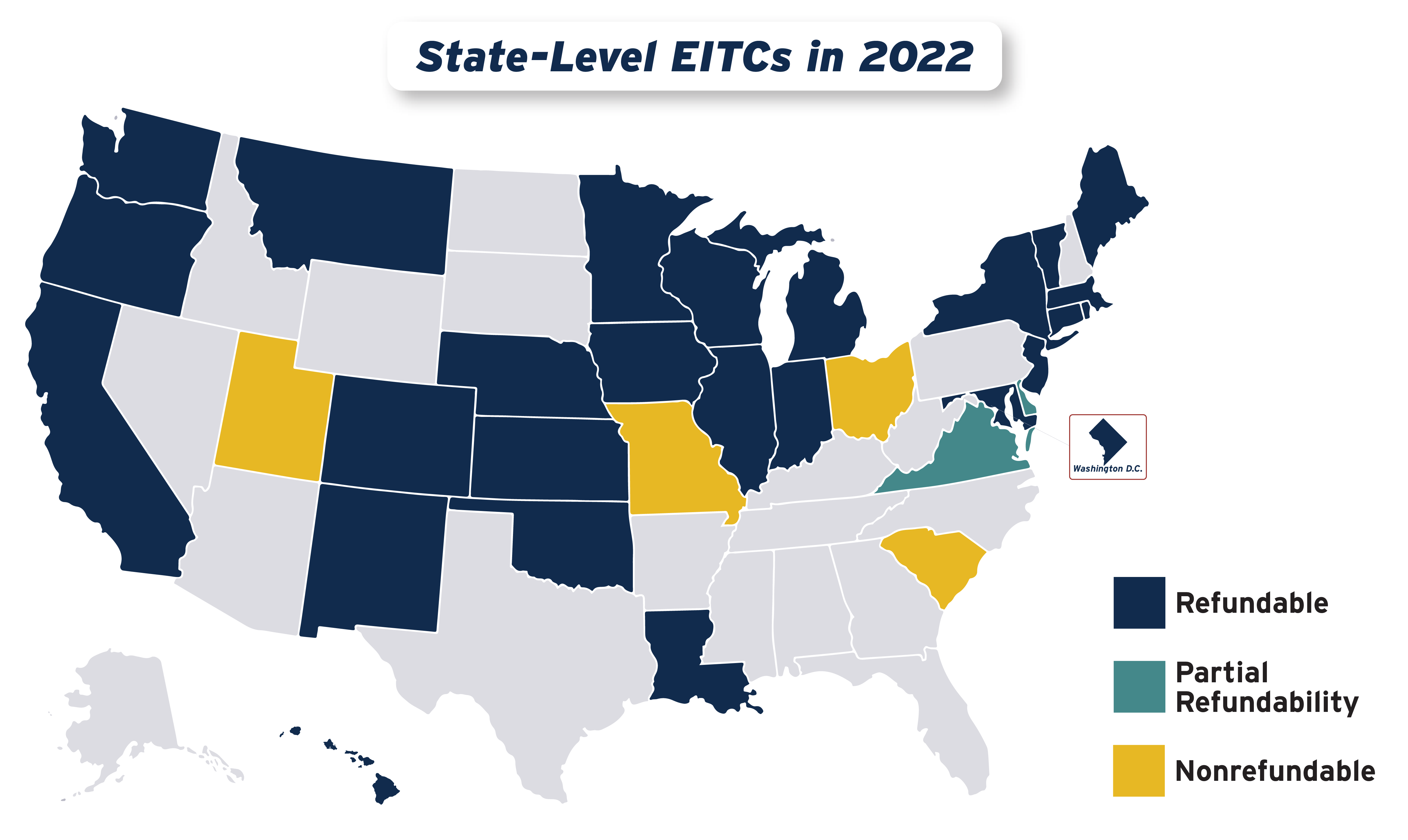

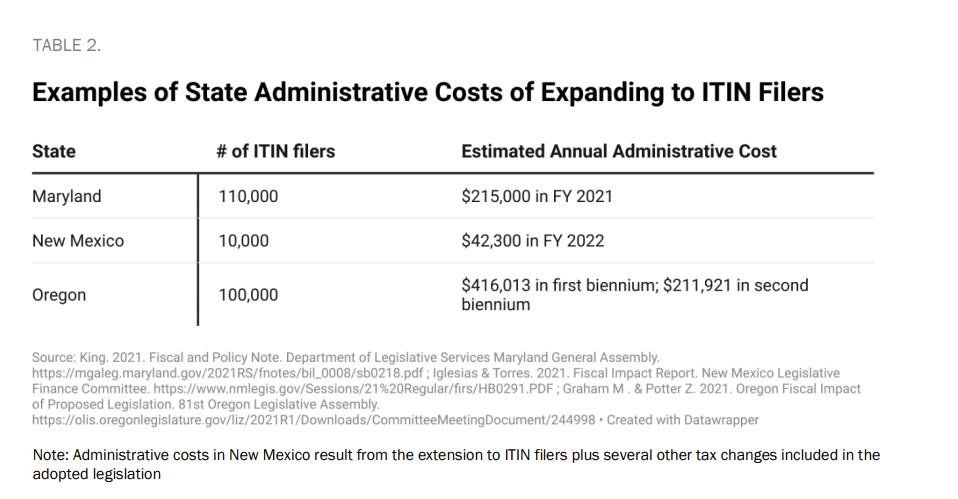

Policy Basics State Earned Income Tax Credits Center On Budget And Policy Priorities

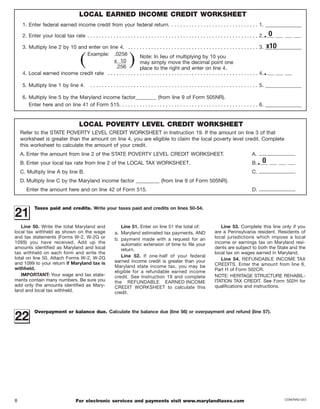

Local Earned Income Credits A taxpayer can also claim a nonrefundable earned income credit against the local income tax.

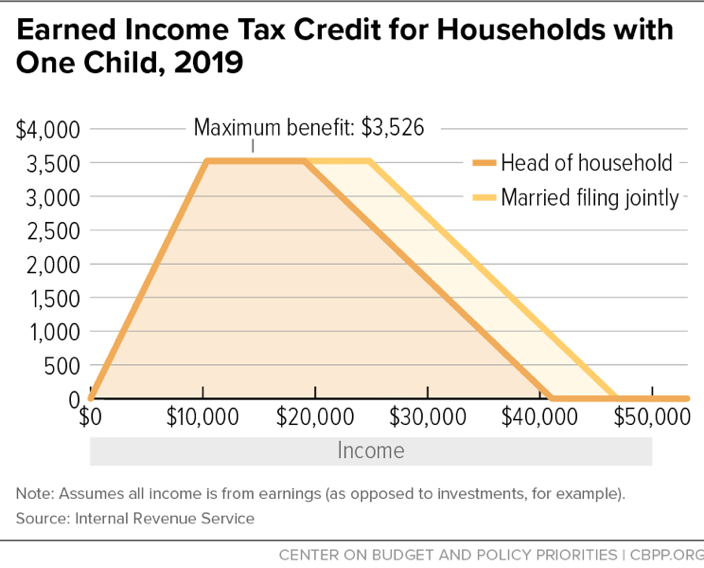

. Detailed EITC guidance for Tax Year. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years.

See Worksheet 18A1 to calculate any refundable earned. Detailed EITC guidance for Tax Year 2021 including. The local income tax is calculated as a percentage of your taxable income.

Data on earned income tax credit claimants. Chapter 7 discusses earned income tax credit improper payments and the use of refund anticipation products. Required to file a tax return.

About 86000 people in Maryland file tax returns without using a Social Security. Thestate EITCreducesthe amount of Maryland tax you owe. If you qualify you can use the credit to.

Ii Primary Staff for This Report. Local officials set the rates which range between 225 and 320 for the current tax year. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

The state EITC reduces the. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the.

The amount of the credit allowed against the local. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. CASH Campaign of Maryland 410-234-8008 Baltimore Metro.

Local income tax revenues decrease by. Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. Chapter 8 and 9 assess the.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. States and Local Governments with. Local income tax revenues decrease due to additional local earned income tax credits claimed against the personal income tax.

Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. Businesses and Self Employed. Maryland local earned income tax credit Monday October 24 2022 Edit.

The earned income tax credit is praised by both parties for lifting people out of poverty. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit.

Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less.

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Earned Income Tax Credits Urban Institute

Form W 2 Wage And Tax Statement For Hourly Salary Workers

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

If You Are A Nonresident Employed In Maryland But Living In A Jurisdi

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

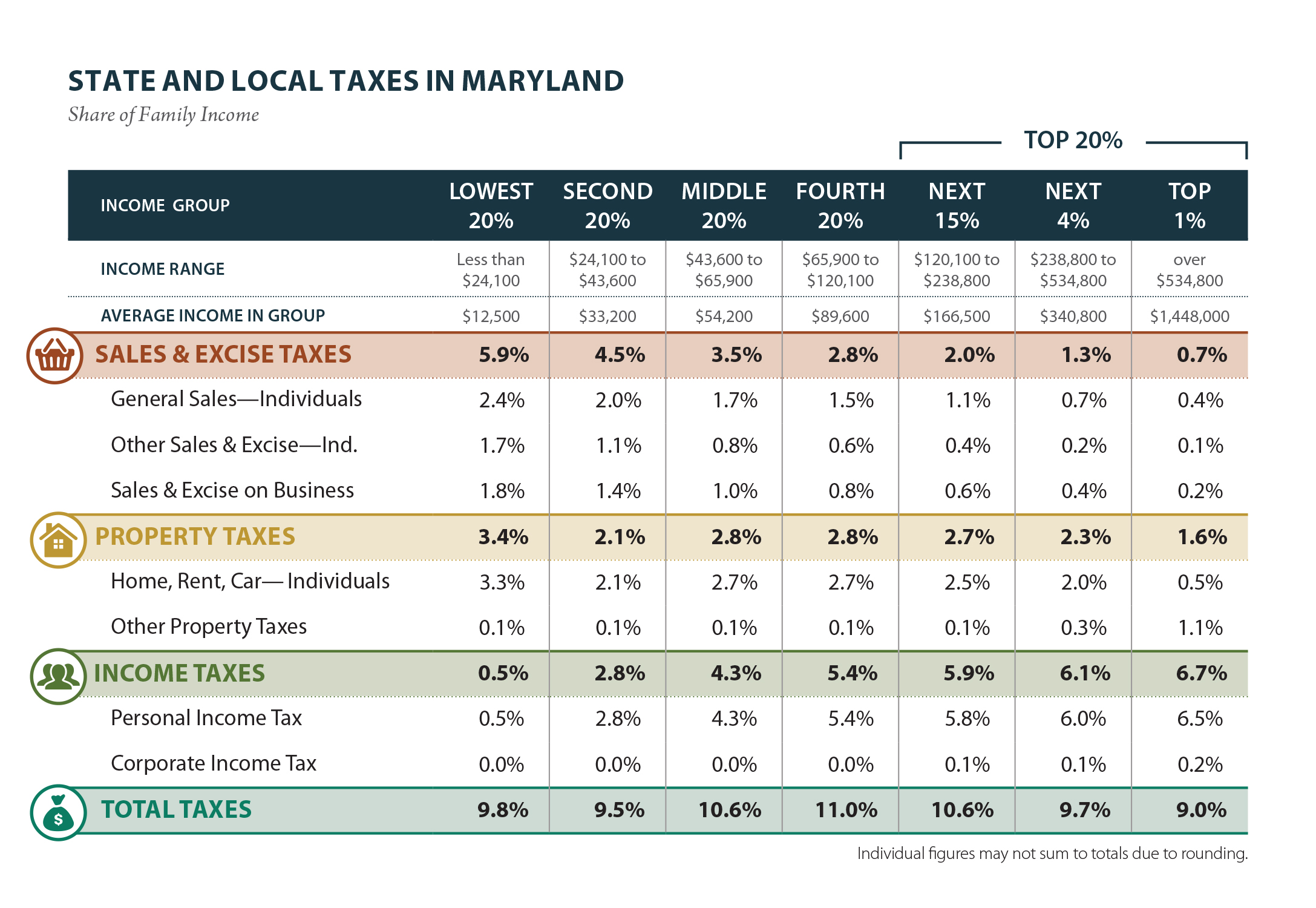

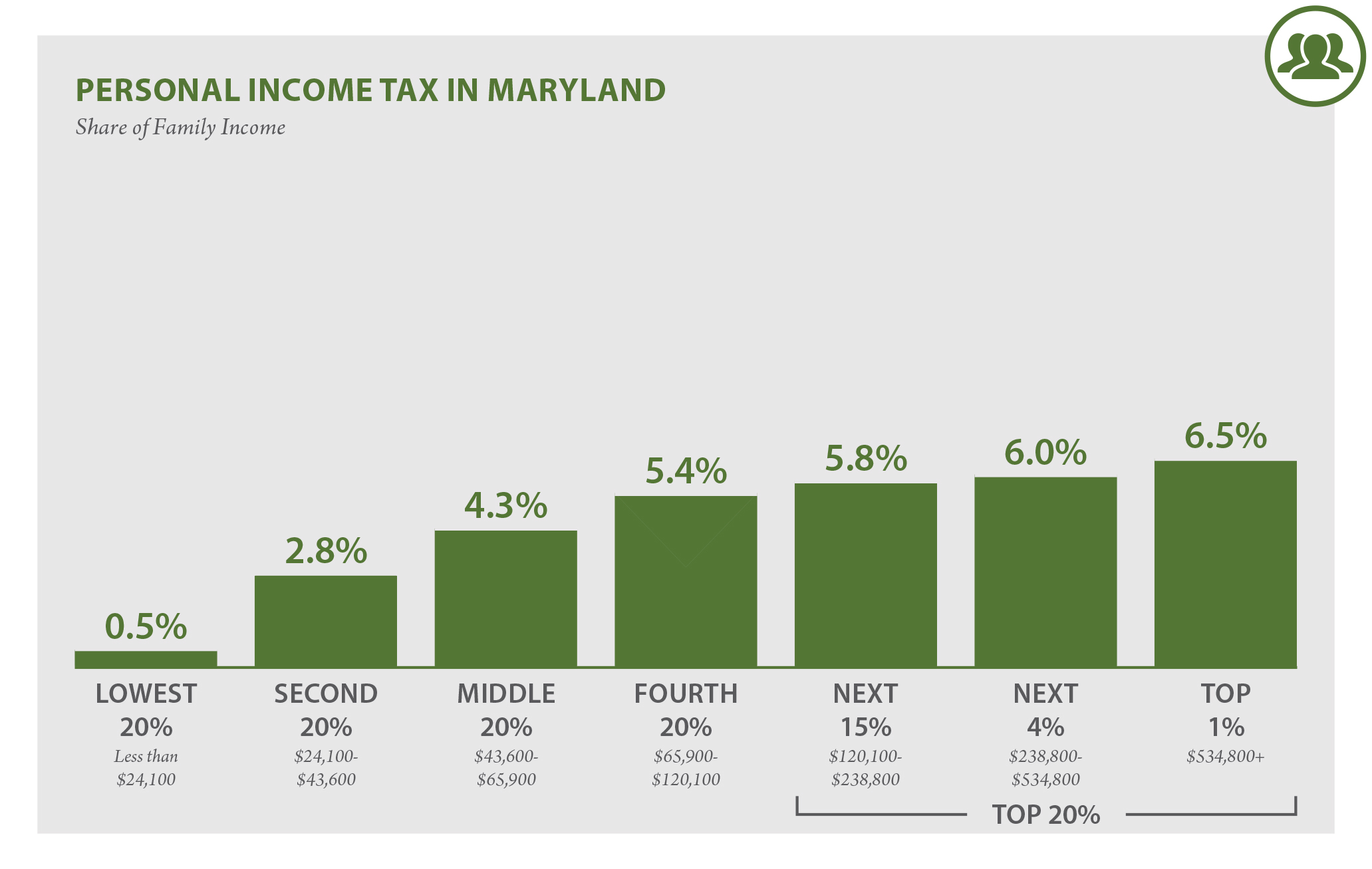

Maryland Who Pays 6th Edition Itep

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

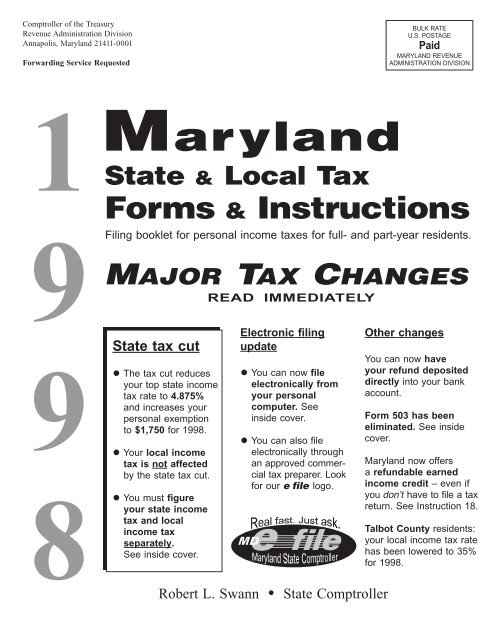

Resident Book B Amp W Internet The Comptroller Of Maryland

Earned Income Tax Credit Now Available To Seniors Without Dependents

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

States Boost Earned Income Tax Credits For Pandemic Relief

Maryland Who Pays 6th Edition Itep

Governor Hogan S Tax Relief Package State Local Fiscal Effects Conduit Street